In Brief — What Is a VCC?

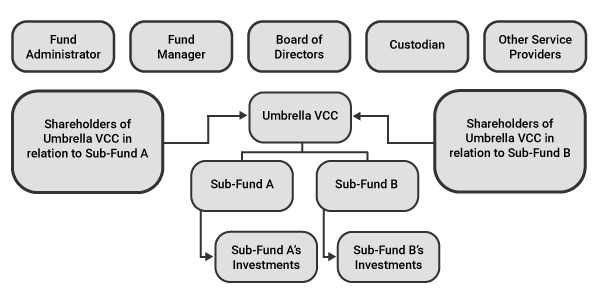

A VCC is a new Singapore investment vehicle that has been assigned its own legal structure and corporate entity. In essence, it allows investors to hold funds within an umbrella fund, while still being treated as a single company for tax purposes. A VCC will undoubtedly be an attractive option as an alternative to existing fund/collective investment schemes (CIS), such as unit trusts, partnerships, corporations, etc. VCCs can either be open-ended or close-ended, providing extra flexibility where needed. As Second Minister for Finance Indranee Rajah said, “The introduction of this corporate structure, known as the variable capital company or VCC, will be a game-changer for Singapore’s fund management industry.”

As Second Minister for Finance Indranee Rajah said, “The introduction of this corporate structure, known as the variable capital company or VCC, will be a game-changer for Singapore’s fund management industry.”

The VCC is expected to substantially bolster Singapore’s reputation as one of the premiere global investment hubs, as it brings it up to speed with competitors such as Mauritius and the Cayman Islands. One of the main goals of the VCC is to encourage the re-domiciliation of these foreign funds into Singapore, with optimum ease and transparency.

If you’d like a more in-depth analysis of the benefits of the VCC, you can read our article on this exciting investment vehicle here.VCC Income Tax Treatment

Summary

All VCC’s are incorporated under the VCC Act, and are to be treated as companies under the Companies Act for the purpose of income tax.Tax Residence for VCCs

- Any VCC will be considered a resident of Singapore for tax purposes if it is controlled and managed in Singapore for the calendar year.

- Any sub-fund of the VCC will have the same tax residence as the umbrella fund.

- A VCC can apply for Certificate of Residence (COR) for the purpose of avoiding double taxation. The COR will be issued in the name of the umbrella VCC with the name of the sub-fund included in the COR.

Distributions by VCCs

- Dividends paid by a VCC with tax residence in Singapore are exempt from tax for its shareholders.

Income of VCCs

- In general, VCCs are considered companies for tax purposes, so will enjoy the same tax incentives and tax deductions as Singapore companies.

- As VCCs are primarily used as investment schemes, they are only considered for the following tax incentives:

- Exemption of income from a venture company

- Exemption of income from a company incorporated and resident in Singapore arising from investments managed by fund manager in Singapore

- Exemption of income from investments managed by fund managers in Singapore

- A VCC will not be allowed deductions for expenses under a certain section of the ITA.

- A VCC will not be able to transfer or receive losses under the Group Relief System.

Application of Tax Rules at VCC Umbrella and Sub-Fund Levels

- The chargeable or exempt income of an umbrella VCC is the total sum of the chargeable or exempt income of its sub funds. The income of a sub-fund is determined as if it were a VCC and the tax rules are applied at the sub-fund level. Tax credits, if any, are also computed at the sub-fund level.

- Certain common tax rules are applied separately at the umbrella and sub-fund levels:

- Unabsorbed capital allowances, losses and donations — sub-fund level.

- Shareholding test — sub-fund level.

- Partial tax exemption, start-up tax exemption and corporate tax rebate — VCC level.

- Exemption of gains or profits from disposal of ordinary shares — sub-fund level.

- Modification of provisions for VCCs redomiciled in Singapore — sub-fund level.

- Tax credits — sub-fund level.

VCC Administrative Procedures

Income Tax Filing Requirements

- VCCs are expected to file two income tax forms every year of assessment (YA):

- Estimated Chargeable Income (ECI) – To be filed within three months of the financial year end of the VCC, unless the waiver applies.

- Form C – A complete set of income tax returns which includes the financial statements, as well as its tax computation and supporting schedules.

- Regardless of the number of sub-funds an umbrella VCC has, the umbrella VCC needs only to submit one set of income tax forms for the entire VCC structure.

Registration and Winding-up of Sub-funds

- IRAS does not need to be informed of the registration of new sub-funds.

- However, if an umbrella fund winds up a sub-fund, tax clearance must be obtained from IRAS.

Liquidation of VCCs

- All outstanding tax matters for both an umbrella fund and sub-funds must be taken care of before the liquidation is completed.

VCC GST Treatment

Summary

In relation to GST, each sub-fund is treated as a separate person. Consequently, each sub-fund must assess its GST registration liability on the basis of the value of taxable supplies it makes.VCC GST Registration Liability

- A sub-fund or non-umbrella VCC must register for GST if the value of its taxable services or supplies acquired from overseas suppliers exceeded $1 million for the past calendar year, or is projected to exceed $1 million in the next year.

VCC Accounting for Output Tax and Claiming Input Tax

- A sub-fund or non-umbrella VCC must charge and account for GST on its taxable supplies as a separate taxable person.

- A sub-fund or non-umbrella VCC may also be subject to reverse charges on imported services. For more information on reverse charges, you can refer to the GST e-Tax Guide “Taxing imported services by way of reverse charge”.

- A sub-fund can claim expenses on GST incurred by the umbrella VCC for that sub-fund only. Common expenses must be allocated to the sub-funds on a reasonable basis.

- GST claims must be supported by relevant invoices issued to the sub-fund or non-umbrella VCC.

VCC Collection and Enforcement

- GST registered VCCs (both umbrella and sub-funds) must file their own GST returns. GST refunds due to one sub-fund cannot be used to discharge GST liabilities of other sub-funds, even where that sub-fund is wound up.

Claiming GST on Expenses for Qualifying VCCs

- VCCs can qualify for GST remission if:

- The VCC satisfies the conditions for particular income tax concessions, and

- The VCC must be managed by a qualifying fund manager in Singapore.

- Qualifying VCCs can recover GST incurred on expenses, with the exception of expenses that fall under regulations 26 and 27 of the GST (General) Regulations.

- To claim incurred GST, a qualifying sub-fund or non-umbrella VCC must file quarterly Statements of Claims to IRAS.

- For more information on the procedures and e-Filing of the Statement of Claims, refer to the finance page of the IRAS website.

Stamp Duty Treatment for VCCs

Summary

- In the case of an umbrella VCC, the sub-funds are treated as separate persons for stamp duty purposes, i.e., stamp duty is levied at the sub-fund level.

- This is consistent with the principle that sub-funds have segregated assets and liabilities.

VCC Stamp Duty on Instruments Executed

- When a non-umbrella VCC executes an instrument, or an umbrella VCC executes an instrument for its sub-fund, it will have the same duties as an instrument executed by a company.

Stamp Duty on Instruments Between an Umbrella VCC and its Sub-funds, or Sub-funds of the Same Umbrella VCC

- When an instrument is made between an umbrella VCC and its sub-funds, or sub-funds of the same umbrella VCC, it will have the same duties as an instrument made between separate companies.

- An umbrella VCC acting on behalf of its sub-fund must state the details of the sub-fund in the instrument.

- If an umbrella VCC executes an acquisition or disposal that is not evidenced by an instrument and had that acquisition or disposal been executed evidenced by an instrument that would have been chargeable with duty, the umbrella VCC must notify the Commissioner of Stamp Duties within 14 days. If the umbrella VCC fails to do so, it will be liable for a fine of up to four times the amount of the original payable duty.

Stamp Duty on Instruments with Shares in a VCC

- An instrument in the procurement of shares for a specific VCC sub-fund will incur share duty, just like any other company.

- Where a non-umbrella VCC or sub-fund is a property-holding entity, and there is a qualifying acquisition or disposal, additional conveyance duty (ACD) is incurred as well as the share duty.

Stamp Duty on Cancellation and Issuance of Shares in a VCC

- Share duty is not chargeable on general cancellation and issuance of shares by a VCC, unless it is to effect a disposal of the shares by a transferor to a transferee.

VCC Tax Treatment Conclusion

The VCC will absolutely make Singapore competitive with other global investment hubs by providing comparable, if not better investment options. It is good that the IRAS has issued that e-Tax Guide to clarify the applicable tax treatment for VCCs, and provide taxpayers with clear rules. While we have tried to give you as much information as possible in a succinct manner, you can read the full VCC IRAS e-Tax Guide. Because the VCC is new territory for most investors, and tax is complicated at the best of times, you might need an expert to guide you through the inevitable complexities. If you have any questions about incorporating a VCC in Singapore, ask us below. If you’d like a personal consultation, please do contact us, and we will be happy to assist.Related Links

FAQs About VCC

What is a VCC?

- A VCC is a new corporate structure for investment funds in Singapore. As the name suggests, the funds will have a flexible capital structure, whereby, according to investor activity, shares can be issued and redeemed.

Are there tax incentives for a variable capital company in Singapore?

- Yes. In general, VCCs are considered companies for tax purposes and will get to enjoy the same tax incentives and tax deductions as Singapore companies.

What are the tax exemptions available for a Singapore variable capital company?

- As variable capital companies in Singapore are primarily used as investment schemes, they are only considered for the following tax incentives:

- Exemption of income from a venture company

- Exemption of income from a company incorporated and resident in Singapore arising from investments managed by fund manager in Singapore

- Exemption of income from investments managed by fund managers in Singapore

When do I need to file income tax for my Singapore Variable Capital Company?

- VCCs are expected to file two income tax forms every year of assessment (YA):

- Estimated Chargeable Income (ECI). To be filed within three months of the financial year end of the VCC, unless the waiver applies.

- Form C. A complete set of income tax returns which includes the financial statements, as well as its tax computation and supporting schedules.