What is a Statutory Audit?

A statutory audit is an annual external audit required by specific regulations established by legislation. Regulatory bodies legally mandate such audits. In Singapore, it is mandatory for all companies to appoint a qualified auditor within three months of their incorporation unless they meet specific criteria for exemption. This requirement ensures that companies maintain transparent financial practices and adhere to regulatory standards. The appointed auditor is responsible for reviewing the company’s financial statements and providing an independent assessment of their accuracy and compliance with accounting principles. Consequently, securing audit services is a crucial step for every newly incorporated company in Singapore. It lays the groundwork for responsible financial management and helps build trust with stakeholders.What is Our Audit Approach?

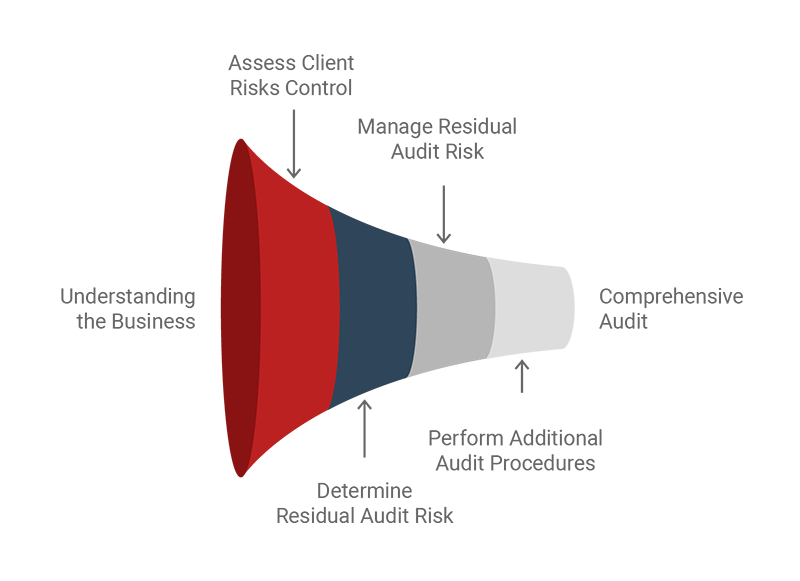

Our audit approach is designed to provide reasonable assurance that the financial statements are not materially misstated and are presented fairly in accordance with applicable accounting standards and relevant statutory requirements. Our audit approach begins with a comprehensive understanding of our client’s business and pinpointing crucial risk areas. We then evaluate the effectiveness of the client’s internal controls concerning those risks.

After that, we identify and address any remaining audit risks based on our evaluation, then execute additional audit procedures to support our final opinion. This approach ensures that we conduct our audit promptly and efficiently while paying attention to any key risk or material areas.

Our client portfolio includes local businesses and multinational corporations, providing us with the ideal mix of technical and business expertise to serve various industries.

Our audit approach begins with a comprehensive understanding of our client’s business and pinpointing crucial risk areas. We then evaluate the effectiveness of the client’s internal controls concerning those risks.

After that, we identify and address any remaining audit risks based on our evaluation, then execute additional audit procedures to support our final opinion. This approach ensures that we conduct our audit promptly and efficiently while paying attention to any key risk or material areas.

Our client portfolio includes local businesses and multinational corporations, providing us with the ideal mix of technical and business expertise to serve various industries.

Audit Preparation Tips for Smooth Compliance

A successful audit is built upon the foundation of diligent preparation. To facilitate a smooth and efficient auditing process, consider the following strategies that can help streamline your efforts and minimise potential obstacles:Inform Key Personnel

Communicate the specific audit dates to all relevant employees and stakeholders. Clearly outline their responsibilities during the audit process to ensure everyone is on the same page. Consider holding a pre-audit meeting to discuss expectations, answer any questions, and address possible concerns.Organise Documents

Before the audit, organise and gather all necessary financial records and documentation. Create a checklist of required documents to ensure nothing is overlooked. Use digital storage solutions to enhance accessibility and facilitate fast information retrieval during the audit. Ensure that all files are properly labelled and categorised for easy reference.Reconcile Accounts

Conduct a thorough review of all financial statements, including accounts receivable, accounts payable, and other ledgers. Identify and rectify any record discrepancies well before the audit date. This may involve comparing internal records against bank statements, invoices, and transaction reports to ensure accuracy and completeness. Addressing these discrepancies in advance will help present a clear and accurate financial picture during the audit.How Can You Check Whether You Qualify for an Exemption?

| For a Private Limited Company | For a Company That is Part of a Group |

|---|---|

You must meet at least two of the three conditions for each of the two previous financial years:

|

The group it belongs to must be classified as small and meet the consolidated thresholds. This means that the entire group must satisfy at least two of the three criteria on a consolidated basis for each of the two preceding years. Additionally, a “group” includes the ultimate holding company, which consists of a group where the ultimate holding company is a foreign entity. |

Consequences for Failing to Comply

Failing to appoint an auditor on time or providing inaccurate information to ACRA in Singapore can lead to penalties.- Section 173A (1) states that a company shall, by notice, furnish to the Registrar;

- Within 14 days after a person becomes a director, chief executive officer, secretary or auditor, and

- Within 14 days after any change (e.g. resignation of directors or secretaries) in the appointment of any director, chief executive officer, secretary or Auditor.

Statutory Audit service is conducted by Precursor Assurance LLP (an Ascentium entity)