Southeast Asia’s Most Competitive Country to Do Business

The Lion City is a roaring force to be reckoned with. It is one of the best places to do business in the world with its world-class infrastructure, talent pool, supportive government, digitally savvy population, and more. Companies can also benefit from its excellent free trade agreements and endless market opportunities, and use it as a gateway to the larger Asia-Pacific region.

Why Singapore is an Economic Hub and International Financial Centre

Singapore provides the most conducive and business-friendly environment for companies looking to expand in the Singapore region, with benefits ranging from low corporate taxation, high productivity, rule of law, robust IP protection, availability of skilled manpower, and good connectivity. So when multinational companies head-quarters their Asian operations in the city-state, they enjoy:Excellent Connectivity and a Strategic Geographical Location

Singapore’s Changi International Airport serves over 80 airlines connecting more than 330 cities; its sea-port infrastructure has been Asia’s best for the past few decades, and the container ports offer 200 shipping lines with links to over 600 ports in 123 countries.Start-Up Friendly Business Ecosystem

Singapore consistently tops (along with New Zealand) World Bank’s ease of doing business rankings due to its hassle-free business set-up and post-incorporation processes; offers the best IP protection, infrastructure and incentives in Asia, as per the World Economic Forum’s Global Competitiveness reports; and ranks as the best-performing Asian country in terms of innovation performance according to the Global Innovation Index.

The city-state is rated as a triple-A rated economy, hosting over 128 commercial banks, 31 merchant banks and 604 capital markets services license holders. It has the world’s third-largest forex trading centre – Singapore Exchange (SGX) and is also the hub for wealth management and investments in Asia. The Government has also put in place a new initiative called Startup SG – a launchpad for entrepreneurs providing access to local support initiatives and a global entrepreneurial network.

Attractive Tax Framework and Extensive Trade Agreements

Singapore has signed over 21 free trade agreements, and 76 comprehensive avoidance of double tax agreements (DTAs). It also offers one of the most attractive corporate tax structures in the world with the corporate tax rate at just 17%.Access to a Highly Skilled Local Talent Pool

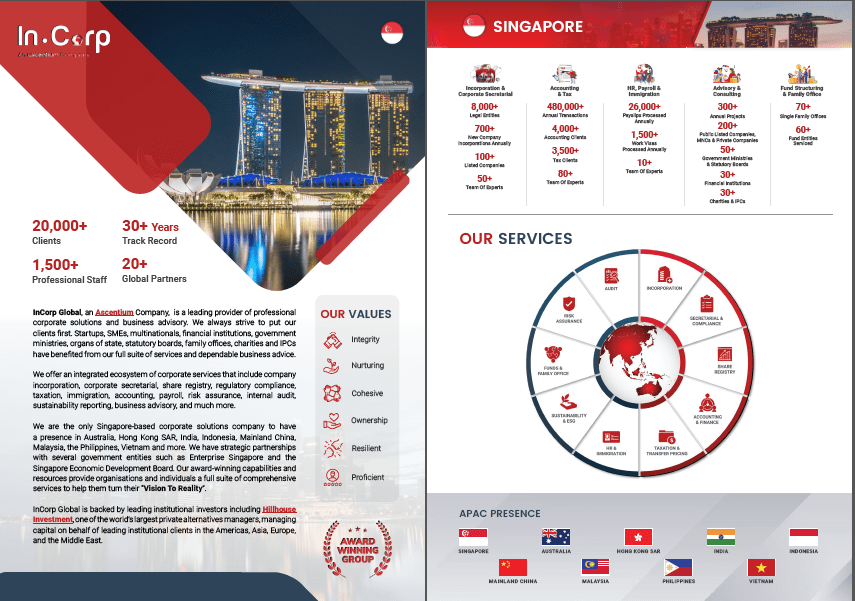

Based on the Business Environment Risk Intelligence (BERI) reports and Global Competitiveness Report 2018 – 2019, Singapore enjoys good working conditions, high rates of productivity, amicable and corporative employer-employee relations, as well as an English-speaking, and highly-skilled local labour force. Thus, Singapore – Asia’s business epicentre – enjoys a unique position in the global economy, and we, at InCorp Group, are best placed to help entrepreneurs and foreign companies who are opting to start a business in Singapore.InCorp Services Provides the following Corporate Solutions in Singapore:

Incorporation

Find out the requirements to incorporate a Singapore company and how we can help you get started.

Secretarial and Compliance

Our qualified team of corporate secretarial experts can help you tackle the complicated landscape and stay in line with business compliance requirements.

Share Registry

Our share registry service gives you a simple platform for shareholders and regulators to track investments in a company, as well as comply with all legal requirements.

Accounting and Finance

Leave your taxing accounting and finance functions to our competent service team to focus on the business aspects that matter the most.

Taxation

Tax management can get more complex as your business grows. Get effective solutions that fit your business needs and advice to comply with local tax requirements.

Transfer Pricing

Our team will take care of the mandatory transfer pricing documentation so that you can focus on expanding your business globally.

Immigration

Trust our team to handle work visa and dependant’s pass applications for you, your family and your employees as you relocate to Singapore and beyond.

HR & Payroll

Learn about the payroll process and regulatory requirements that Singapore employers must align with, as well as other major considerations in payroll management.

Fund Administration and Family Office

Learn how our fund structuring and administrative services support your family offices and business growth in Singapore and regionally.

Risk Assurance

To tackle uncertainties, we help businesses identify, understand, and respond to risks with a customised and comprehensive ERM framework.