What Makes Singapore a Good Location to Set Up a Family Office?

With the tremendous growth of wealth and affluence in the region over the past decade, there has been an exponential increase in the number of super-rich individuals and families. Asia has one of the fastest-growing populations of high net-worth individuals (“HNWIs”), leading to a deep concentration of wealth. As these HNWIs look to preserve, grow, and transfer their wealth to future generations, it is no surprise they will seek a choice location that possesses the attributes conducive to wealth management. Singapore ranks highly as one of the preferred locations given its standing as a leading financial centre. Besides being a stable and well-regulated financial hub, it has wealth-friendly regulations and an attractive tax regime. Together with its deep pool of talent in the private banking, asset management, legal, and finance sectors, it makes Singapore one of the most attractive places to set up a family office.Typical Family Office Structure

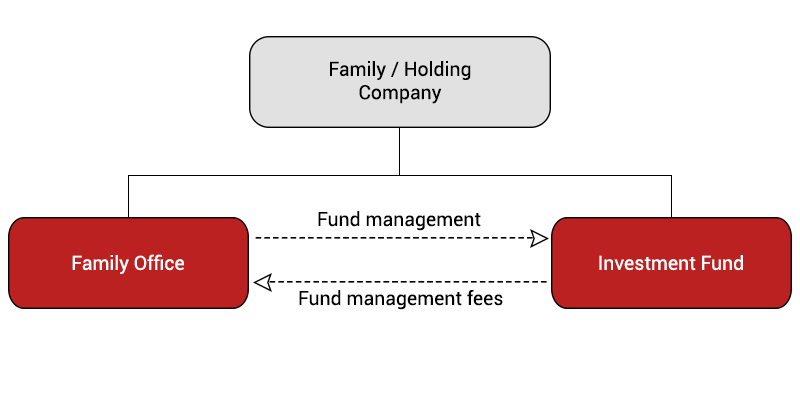

The family office has long been a familiar concept in both Europe and the USA. With the growth of wealth in Asia, the family office has emerged as a popular wealth management solution that can be tailored to meet the needs of HNWIs and their families. It is essentially a fund management advisory company set up to oversee the administration, preservation, growth, and intergenerational transfer of a high net-worth family’s assets and investments. In a Single-Family Office (SFO), the legal entity manages the financial and personal matters for one family and is wholly owned by the family members of the same family. A typical SFO ownership structure is depicted in the diagram below:

What Are Factors to Consider When Establishing a Family Office?

Each HNW family will have specific needs and objectives for establishing a family office. There is no generic family office structure and each family office has to be customised according to the requirements of the family, taking into consideration the various factors, such as:- The objectives for setting up the family office

- The types of assets that will be injected into the family office

- The investment strategy and mandate for the family office

- The regulatory requirements and tax incentives available

How InCorp Can Help

As a full-suite corporate business solutions provider, we have the expertise to support family offices and help HNWIs and their families to use Singapore as their base to manage their wealth.

The services we offer include:

Setting up and Implementation

We will discuss with you your needs and objectives before proposing a structure that best supports the family office’s future immediate and future plans. We will explain the requirements and key considerations so that you are able to make informed decisions when selecting the optimal structure.- Advice on the appropriate structure for the family office

- Advice on the regulatory requirements

- Assist in tax planning, migration and re-domiciliation matters

- Set up of corporate entities of the family office

- Assist in obtaining tax incentives and liaising with the relevant government authorities

- Transfer pricing analysis for the management services rendered by the family office

Ongoing Operations

We have dedicated teams that are well-equipped to support you in all aspects of the day-to-day needs of the family office. These include:- Bookkeeping

- Preparation of financial statements

- Internal audit

- Corporate secretarial

- Payroll

- Immigration

- Annual tax filing for trusts, funds and the family office

- Annual tax filing of individual tax returns for family members and employees of the family office

- Attending to queries from the tax authorities and other government authorities

- Annual declaration for tax incentives

- Assist in tax reporting matters in respect of Common Reporting Standards and FATCA

Ad-hoc Consultancy

We provide support to help you assess new investment opportunities and the optimal acquisition structure. We also provide transactional advice so that you are aware of the different implications and are able to make well-considered decisions.- Transaction advisory

- Financial and tax due diligence

- Cash flow forecast and projections

- Valuation

- Tax advice on the following areas:

- Cross border tax planning

- Structuring – choice of location and types of investment vehicles

- Treaty analysis

- Asset transfers

- Repatriation and distribution of income/ profits

- In-country tax analysis

FAQs

The family office has for a long been a familiar concept in both Europe and the USA. With the growth of wealth in Asia, the family office has emerged as a popular wealth management solution that can be tailored to meet the needs of high-net-worth individuals and their families. It is essentially a fund management advisory company set up to oversee the administration, preservation, growth, and intergenerational transfer of a high net-worth family’s assets and investments. In a Single-Family Office (SFO), the legal entity manages the financial and personal matters for one family and is wholly owned by the family members of the same family.

Each high-net-worth family will have specific needs and objectives for establishing a family office. There is no generic family office structure and each family office has to be customised according to the requirements of the family, taking into consideration the various factors, such as:

- the objectives for setting up the family office

- the types of assets that will be injected into the family office

- the investment strategy and mandate for the family office

- the regulatory requirements and tax incentives available

To promote the asset management industry and encourage the establishment of family offices, Singapore has introduced various tax incentive schemes that are available to both the family office and the investment fund. Further details on the schemes can be found here.

As high-net-worth individuals look to preserve, grow and transfer their wealth to future generations, it is no surprise they will seek a choice location that possesses the attributes conducive for wealth management. Singapore ranks highly as one of the preferred locations given its standing as a leading financial centre. Besides being a stable and well-regulated financial hub, it has wealth-friendly regulations and an attractive tax regime, making it a popular location for family offices.