Watch this insightful webinar session, created specifically for statutory auditors seeking to strengthen their understanding of transfer pricing (TP) compliance and documentation requirements.

This high-impact webinar addressed the growing regulatory scrutiny around TP and highlighted the critical role of auditors in identifying compliance risks hidden within financial statements.

Viewers will gain practical tools to spot red flags in related party transactions, understand the regulatory thresholds that may trigger TP documentation obligations, and assess the adequacy of disclosures and supporting evidence.

Through real-world examples and expert insights, this session empowers auditors to proactively detect TP issues before they escalate, enhancing audit quality and supporting better compliance outcomes.

Watch this insightful webinar session, created specifically for statutory auditors seeking to strengthen their understanding of transfer pricing (TP) compliance and documentation requirements.

This high-impact webinar addressed the growing regulatory scrutiny around TP and highlighted the critical role of auditors in identifying compliance risks hidden within financial statements.

Viewers will gain practical tools to spot red flags in related party transactions, understand the regulatory thresholds that may trigger TP documentation obligations, and assess the adequacy of disclosures and supporting evidence.

Through real-world examples and expert insights, this session empowers auditors to proactively detect TP issues before they escalate, enhancing audit quality and supporting better compliance outcomes.

Key Discussion Points:

- How to identify the signs of related party transactions

- Understanding TP thresholds and triggers

- Evaluating financial disclosures and supporting documentation

Why You Should Watch:

Increased regulatory focus on transfer pricing means statutory auditors must be more vigilant than ever. This session is designed to help you spot red flags, assess disclosures, and ensure compliance with TP documentation requirements before issues arise. Ideal for Audit companies and Audit service providers!Watch the Recorded Webinar

About the Speakers

-

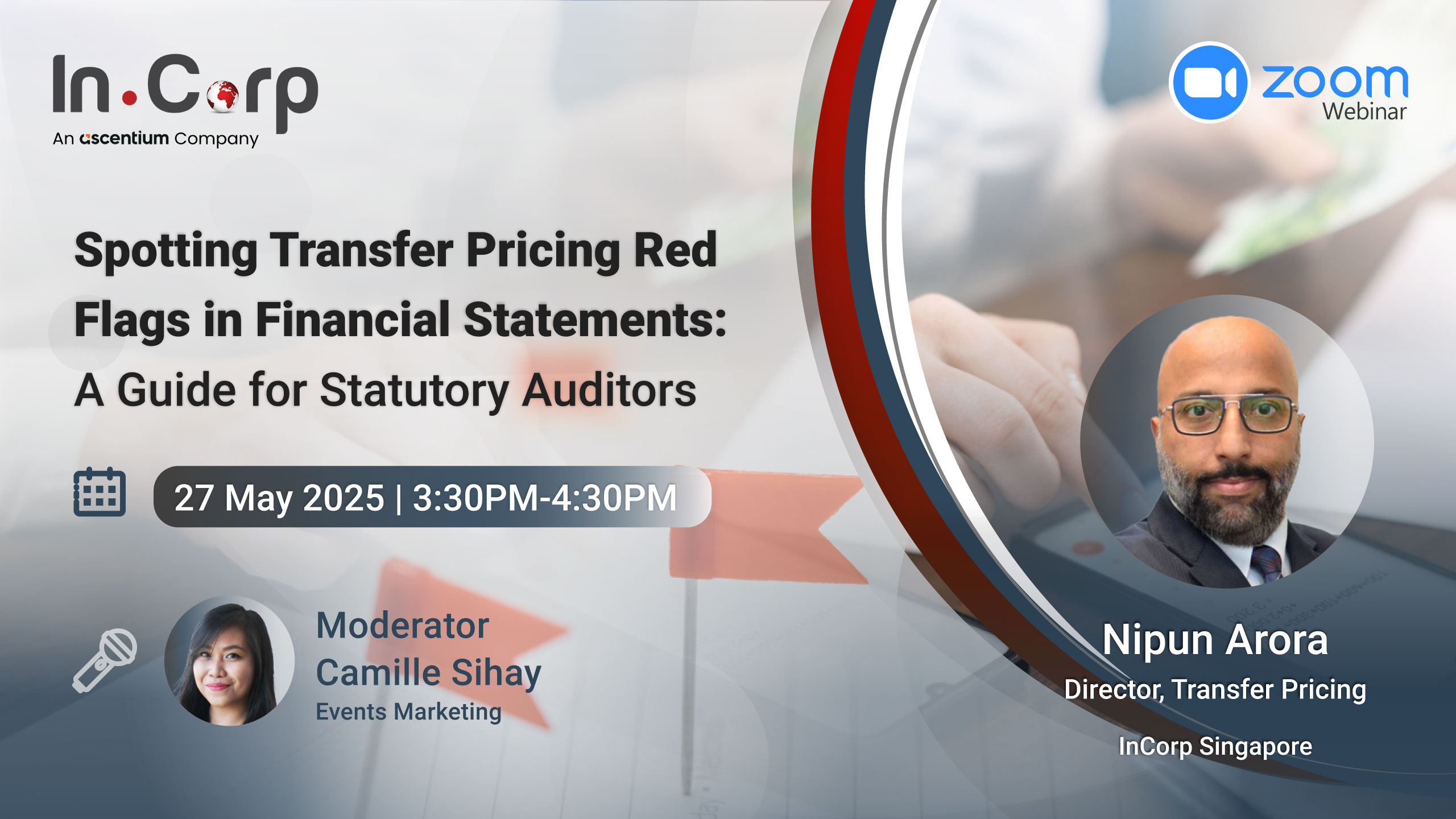

Nipun Arora

Director, Transfer Pricing

Nipun is the Director of the Transfer Pricing practice of InCorp Singapore. He has over 20 years of experience in transfer pricing, having worked with the Big 4 accounting firms for most of his career.

Nipun provides advisory services on transfer pricing to SMEs and multinational companies from the industries of automotive, retail, telecom, FMCG, and luxury goods. He assists clients in preparing year-end transfer pricing documentation, transfer pricing due diligence, litigation advisory, family-office advisory, drafting of inter-company agreements and advising structures that are tax efficient.