Despite the fact that charities are social institutions established to provide help, support, or services to those in need, or to advance a specific cause for the public good, they may face misuse or be exploited by illegal actors.

These individuals or organisations may use such non-profit institutions to raise or move funds for purposes such as Money Laundering (ML), Proliferation Financing (PF), and Terrorism Financing (TF).

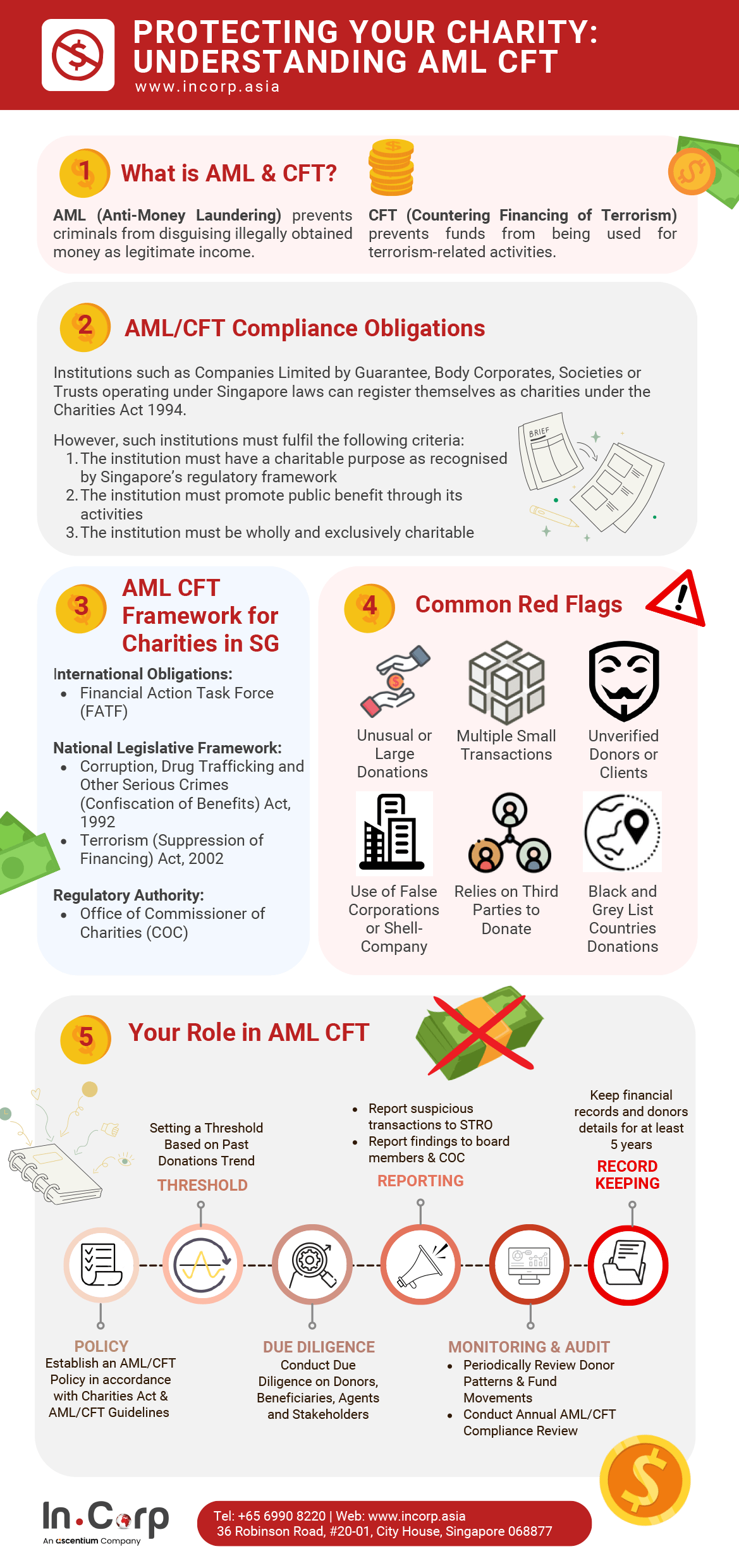

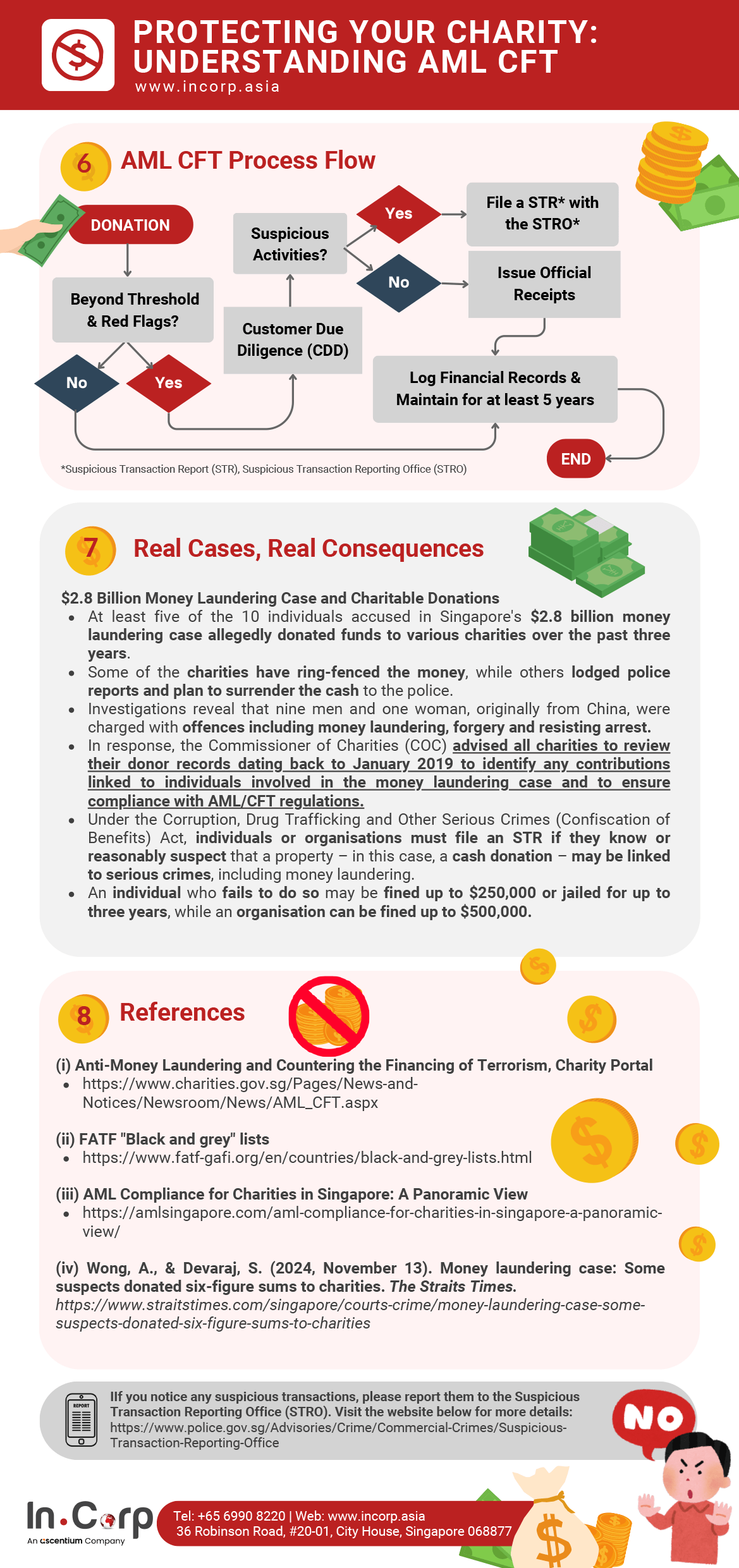

To combat this, Singapore has Anti-Money Laundering (AML) and CFT (Countering the Financing of Terrorism) compliance obligations in place that organisations such as societies or trusts intending to register themselves as charities must fulfil.

In the infographic below, we detail the importance of such compliance frameworks for charities, including red flags, the AML CFT process flow, and more.

Why Must Charities Comply With AML and CFT Compliance Requirements?

Charities are especially vulnerable to the risks mentioned above because of these reasons:

- Unregulated funding channels, including the acceptance of anonymous donations

- Greater public trust

- Weak internal controls and governance

- International operations

- Use of intermediaries to deliver aid or services

Why Are CFT and AML Compliance Important for Charities in Singapore?