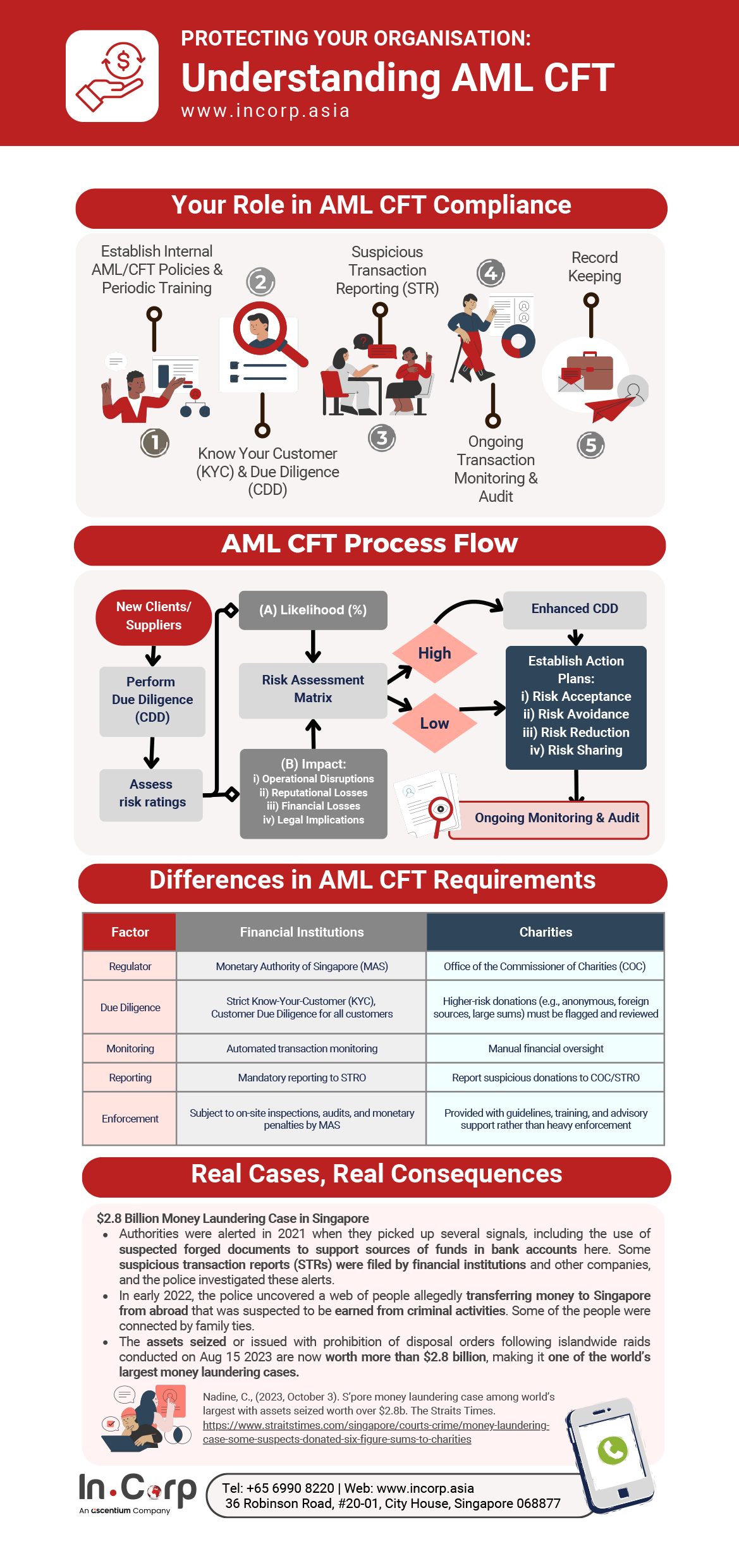

Singapore backs international initiatives to fight money laundering, terrorism financing, and proliferation financing. This is why it actively participates in safeguarding the nation from illicit activities as a member of the Financial Action Task Force (FATF).

The FATF acts as the international authority responsible for setting standards and overseeing anti-money laundering to counter the financing of terrorism and counter-proliferation financing (AML/CFT/CPF).

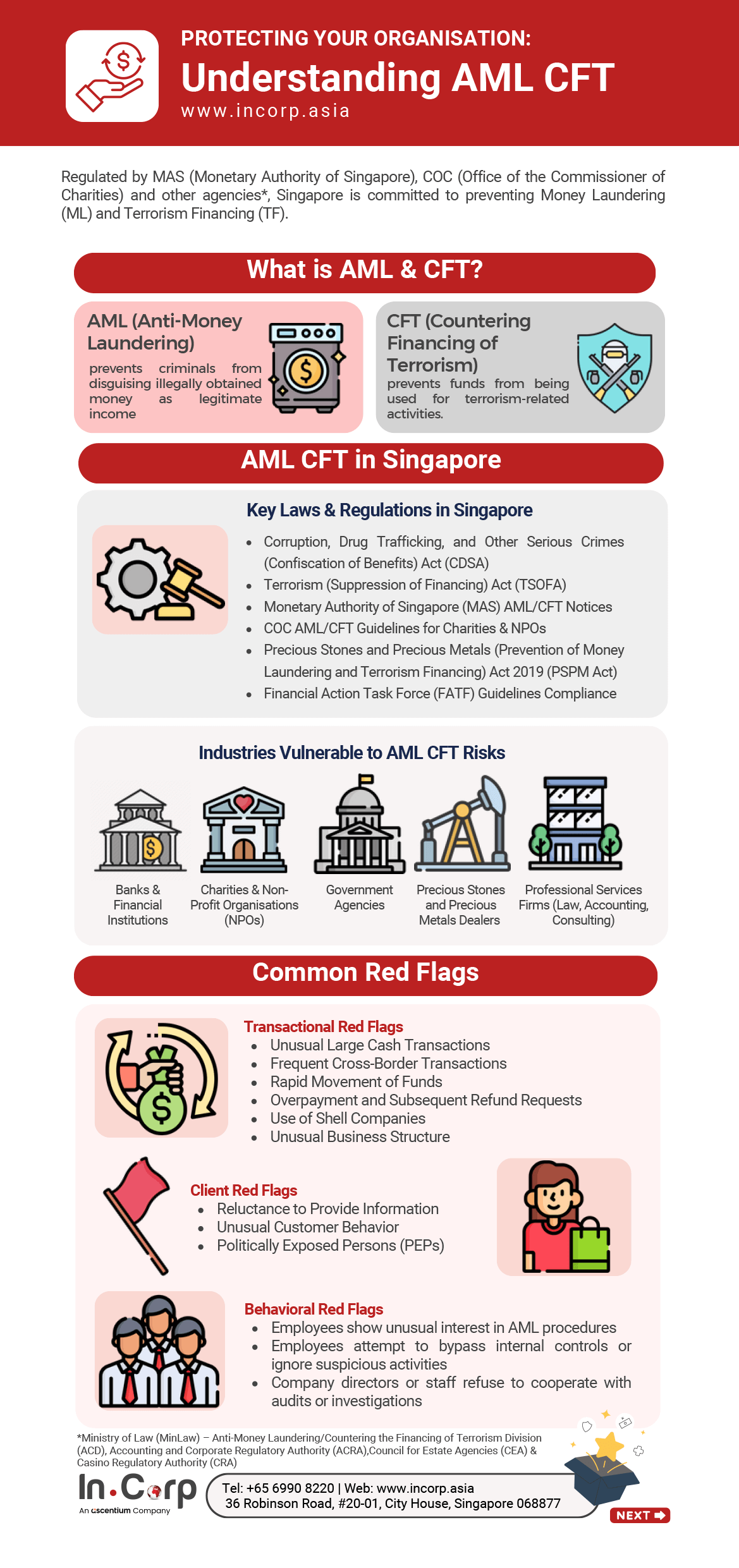

AML (Anti-Money Laundering) and CFT (Countering the Financing of Terrorism) frameworks play a crucial role in safeguarding businesses by protecting them from financial crimes, reputational damage, and regulatory penalties, as we will explore in the infographic below.

What Are the Main Laws and Regulations in Singapore?

Some of the key regulations under AML and CFT are:

- The CDSA

- The TSOFA

- MAS AML/CFT Notices

- PSPM Act

- FATF Compliance Guidelines

- COC AML/CFT Guidelines for Charities and NPOs

What is the Difference Between AML, CFT, and KYC?

AML, CFT, and KYC (Know Your Customer) are all interconnected concepts in financial compliance, but they serve distinct purposes.

For example, the purpose of AML is to prevent and detect the process of disguising illegally obtained money as legitimate income. CFT prevents the use of financial systems to fund terrorist activities, and KYC verifies the identity of customers to ensure they are legitimate and not involved in illegal activities.