The world is gradually opening up, but in some ways, it is also doing the reverse.

This year, the global economy is the primary factor that is expected to affect Singapore’s growth.

The world economy is shifting towards one that prioritises national gain and security instead of mutual benefit and reliance.

As we step into a new age where the mindset of “winner takes all” prevails, countries with smaller economies such as Singapore may find themselves less welcomed.

Therefore, in his Budget 2023 speech, Deputy Prime Minister and Finance Minister Lawrence Wong emphasised the need to adjust to a new era of global progress.

How will the government prepare us for a new age of fragmentation worldwide? What are some initiatives that businesses can look towards to help them cope with this new environment and increased volatility?

We take you through the key things to note in Budget 2023 to answer these questions:

Table of contents

- S$4 Billion National Productivity Fund Topup

- EEG and EFS Extended for 1 Year

- New Enterprise Innovation Scheme to Reduce Tax

- 15% Minimum Effective Tax Rate for Large MNEs

- Growing Local Enterprises

- CPF Monthly Ceiling to Be Raised to S$8,000 by 2026

- Navigate a New Era Successfully in Singapore With Budget 2023

S$4 Billion National Productivity Fund Topup

For decades, Singapore has been a hotspot for MNEs to invest in industries such as finance, oil, and pharmaceuticals.

However, this flow of investment is currently facing a crisis as China and the United States, the 2 biggest economies in the world and its top trading partners, are locked in a geopolitical and economic fight.

Hence, the government is ramping up its efforts to secure more high-quality investments by topping up S$4 billion to the National Productivity Fund. Its scope will be widened to support investment promotion.

Additionally, it will also support firms to develop new capabilities, provide greater value to local ecosystems, and help our workers upskill.

The fund offers long-term support for productivity, continuing education initiatives, and strategies. Overall, this move aims to create better-paying jobs for Singaporeans.

EEG and EFS Extended for 1 Year

Minister Wong also announced the extension of existing enhancements, such as the Energy Efficiency Grant (EEG) and the Enterprise Financing Scheme (EFS), to 31st March 2024.

The EEG offers continued aid for businesses in these sectors to invest in energy efficiency to lower the impact of higher electricity prices:

- Food services

- Food manufacturing

- Retail

The EFS grants Singapore businesses with more ready access to credit, and it includes support for:

- Local construction projects through project loans

- A 70% government risk-share for trade loans

These extensions will help businesses navigate the challenges at hand with financial aid and provide breathing space for them to continue operations.

Related Read: Your Ultimate Guide to the Best Business Grants in Singapore »

New Enterprise Innovation Scheme to Boost Innovation

The Singapore government understands the need to grow and maintain extensive innovation throughout its economy. It has proven this by continuously committing resources to R&D activities.

However, it also knows that innovation requires the undertaking of risk, which may deter some companies as they find it tougher to do so during slower growth and greater expenses.

Hence, Minister Wong announced a new Enterprise Innovation Scheme to help companies get bigger tax deductions when they engage in 5 key activities:

- Research and development in Singapore

- Registering intellectual property, including patents and trademarks

- Obtaining and licensing of intellectual property (IP) rights for taxpayers that have revenue of less than S$500 million

- Innovation in partnership with polytechnics and ITEs

- Training through Skillsfuture-approved courses that are aligned to the Skills Framework

The government will increase tax deductions to 400% of the qualifying expenses, an increase from the current 250%.

The qualifying expenses are limited to S$400,000 for each activity, except for innovation performed with polytechnics and ITEs, which will be capped at S$50,000.

Related Read: How Consumer Innovation in Singapore Drives Corporate Ventures »

15% Minimum Effective Tax Rate for Large MNEs

For the financial year (FY) starting from 1st January 2025, vast MNE groups must implement Global Anti-Base Erosion (GloBE) rules under BEPS Pillar 2 and Domestic Top-up Tax (DTT).

BEPS 2.0 is an international framework for the rectification of global tax rules.

As a result, an international minimum effective tax rate of 15% will be implemented for big Singapore multinational enterprises in 2025.

A local top-up tax will also be levied, increasing their effective tax rate to 15%. Both foreign subsidiaries of Singapore parent firms and MNEs in Singapore will be subject to the new tax rate.

This progressive move limits the tax incentives that Singapore can use to draw foreign investments, which may reduce our attractiveness when put against other bigger economies.

To tackle this limitation, the government will review and update its industry development schemes and focus on high-growth sectors. It will help Singapore remain competitive in terms of attracting and maintaining investments.

Supporting the Growth of Local Enterprises

The government is also focusing on supporting the growth and development of domestic firms. This year, S$1 billion will be set aside to further boost the Singapore Global Enterprises initiative that was first introduced in 2022.

It will support promising local firms to develop into internationally leading organisations, offering committed and customised support. They will partner with experts to enhance their key leadership teams and forge a robust talent pipeline.

Related Read: Why is Singapore a Prime Spot for Top-Tier Foreign Talent? »

Another S$150 million will be put aside via the SME Co-Investment Fund. It will be used to invest in promising SMEs. These moves combined will give local companies greater confidence to expand their businesses beyond borders.

CPF Monthly Ceiling to Be Raised to S$8,000 by 2026

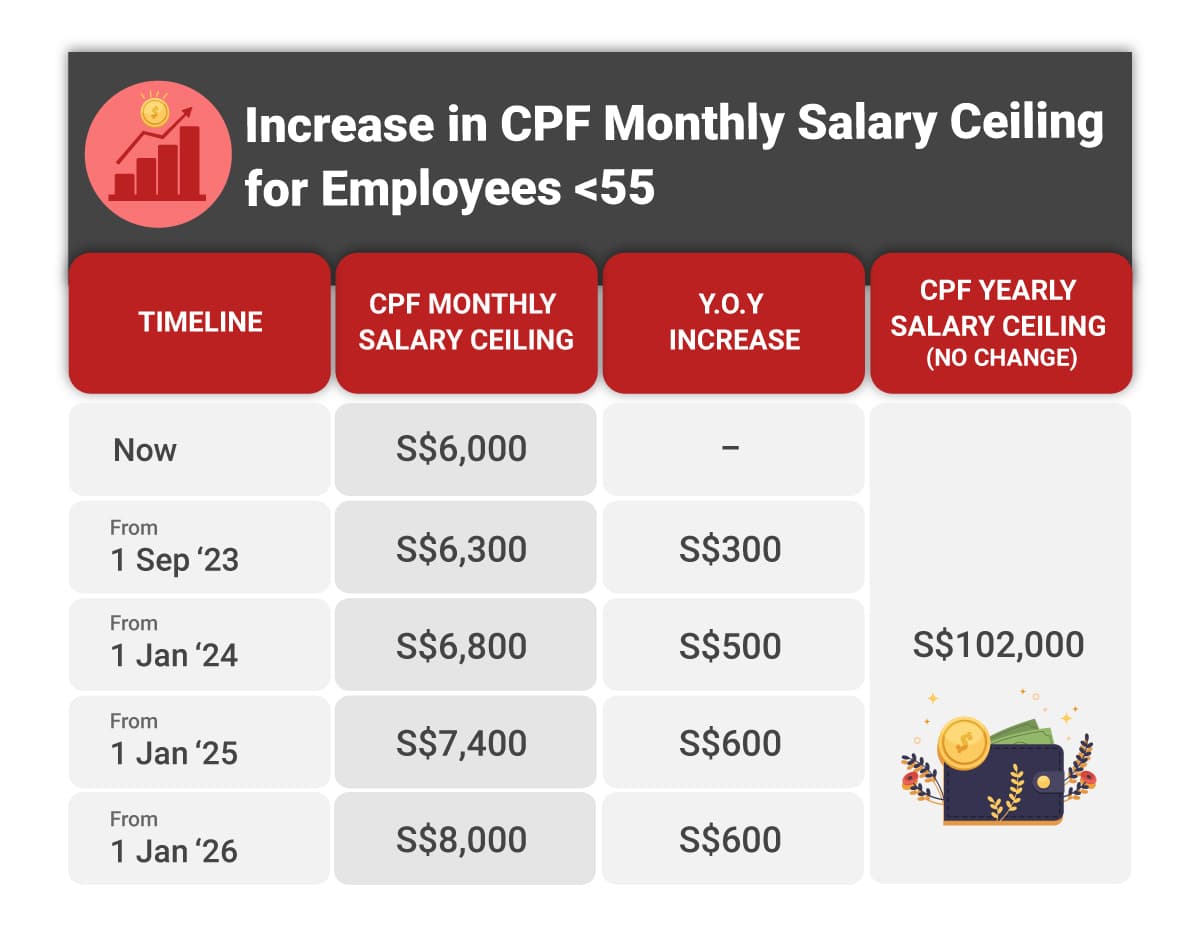

The CPF monthly salary ceiling will be increased from the present S$6,000 to S$8,000 progressively by 2026.

This move will ensure that it keeps up with increasing salaries and supports middle-income citizens in saving more for their retirement.

It will be raised in stages:

The current formula for the CPF contribution rate for employees and employers remains the same, but contributions must be made on monthly salaries of up to S$8,000 from 1st January 2026.

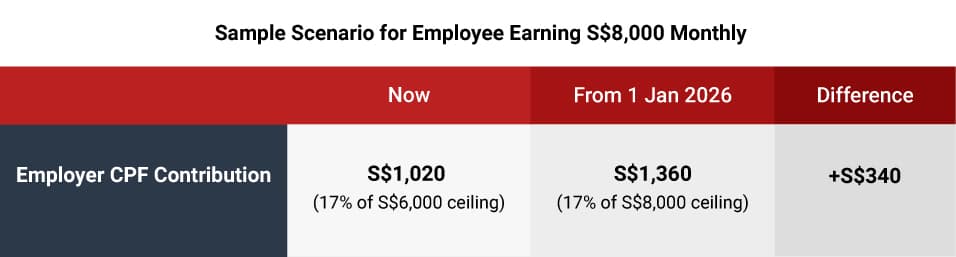

We show how employer CPF contributions will change for an employee aged 55 or below earning S$8,000 every month:

The existing CPF annual salary ceiling of S$102,000 will not be changed at this point. However, it may be reviewed to make sure that it continues to cover most CPF members.

Although the increase is expected to raise business costs, companies are expected to manage it by increasing productivity and using technology in their operations.

Navigate a New Era Successfully in Singapore With Budget 2023

Despite increased volatility and a shifting world economy, Singapore remains a favourable destination for businesses to establish their footing here and in the region.

The government has shown continued support to help the country tide through challenging times with various schemes and initiatives launched over the years, with 2023 being no exception.

InCorp can help to establish and expand your business in Singapore and beyond with our professional corporate services. Speak to our experts to find out more today!

Contact our team

Posts not found!

FAQs

What are some of the Singapore Budget 2023 highlights?

- Some of the Budget 2023 highlights include:

- The CPF monthly ceiling increasing from S$6,000 to S$8,000 by 2026

- New Enterprise Innovation Scheme

- Extension of EEG and EFS grants

What are the tax changes under Budget 2023?

- As part of BEPS 2.0, there will be the implementation of a 15% minimum effective tax rate for large MNEs by 2025.

Why does Singapore continue to be a promising destination for businesses?

- The Singapore government has put forth various policies and initiatives, testament to its commitment to helping the country tide through even the most volatile of times.