What is a Family Office?

A family office is an organisation that serves high-net-worth families. The primary goal of a family office is to manage and preserve the wealth of the family across generations.

What Services Does a Family Office in Singapore Have?

Family offices offer a range of services, including investment management, tax planning, estate planning, philanthropic planning, and wealth transfer.

What Must You Know Before Setting Up a Single Family Office (SFO)?

SFO structures in Singapore are usually made to be exempted from regulation under local securities law, the Singapore Securities and Futures Act (SFA).

As a result, an SFO doesn’t need to have a licence or be registered to offer fund management services to a high-net-worth (HNW) family’s investment vehicles.

SFOs that are licensed to offer fund management services or are exempt from doing so are regarded as fund managers to obtain Singapore’s fund tax management incentives.

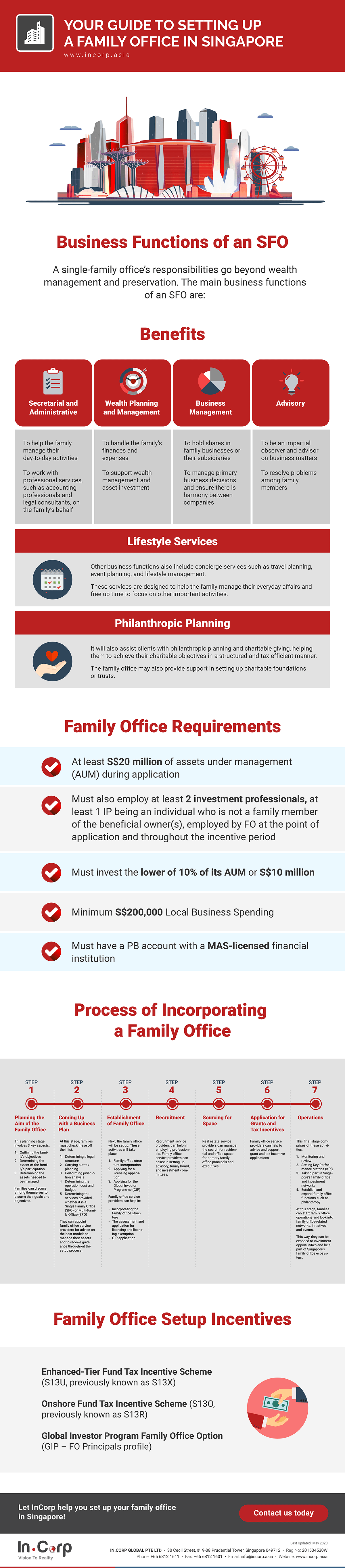

Single Family Office Setup Requirements

Since 5th July 2023, Singapore’s central bank, the Monetary Authority of Singapore (MAS), introduced more stringent criteria for family offices to obtain tax incentives.

Applications for funds managed or directly advised by a family office must have at least S$20 million of assets under management (AUM) during application.

Such family offices must also employ at least 2 investment professionals (IP) with at least 1 IP being an individual who is not a family member of the beneficial owner(s), employed by FO at the point of application and throughout the incentive period.

If an entity in substance only handles funds on a single family’s behalf, but does not fall under the spectrum of current class licensing exemptions, they can apply for a licensing exemption from MAS.