During the recent Budget 2023 announcement, Deputy Prime Minister and Minister for Finance Lawrence Wong announced some key CPF changes.

They include a rise in CPF monthly salary ceiling for workers below 55 and a rise in CPF contributions for senior workers aged 55 to 70.

The Budget measures have been initiated to further support Singaporeans with housing, medical, and retirement needs.

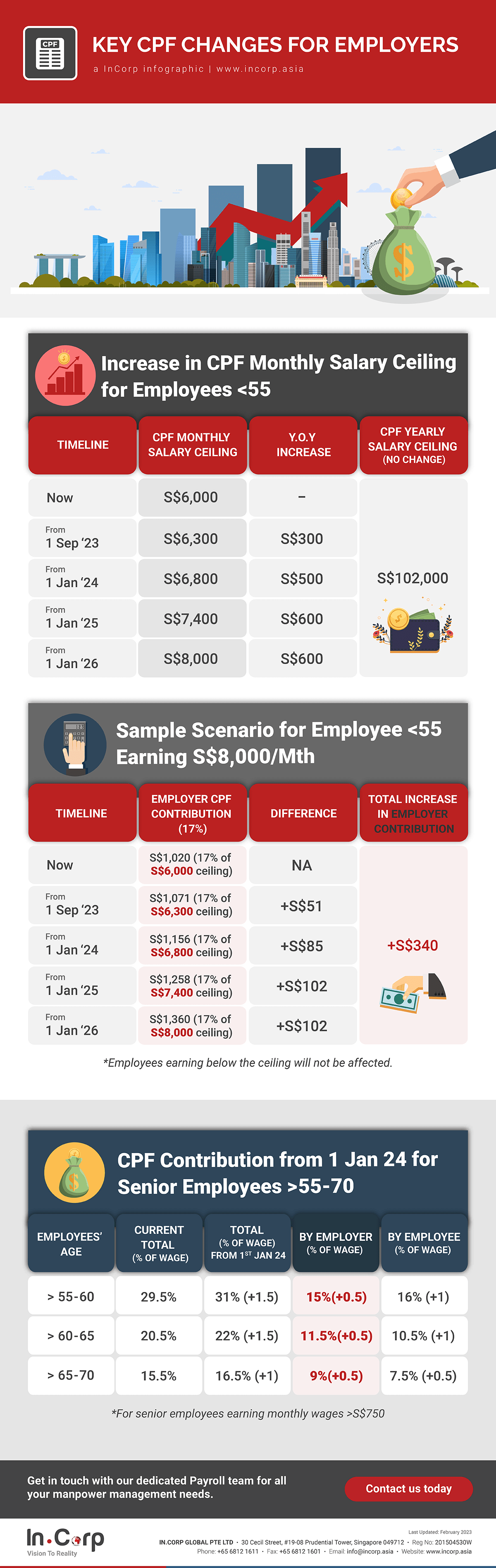

Increase in CPF Monthly Salary Ceiling for Employees Aged 55 and Below

The current CPF monthly salary ceiling, which determines the maximum CPF contributions for Ordinary Wages, is S$6,000.

To keep up with increasing salaries, the monthly salary ceiling will be gradually raised to S$8,000 by 2026. This will occur in four stages to ensure that employers and employees have time to adapt to the changes.

The current CPF annual salary ceiling is set at S$102,000 and will remain the same. Therefore, the CPF annual limit remains unchanged at $37,740.

However, it will be evaluated regularly to ensure that it still covers approximately 80% of employees.

Refer to the infographic below for the stages of salary increase as well as a sample scenario.

CPF Increase for Senior Employees Aged >55 to 70

The CPF contribution rate for senior employees aged 55 to 70 is set to increase from 1st January 2024.

The increase aims to encourage them to continue working and contributing to their CPF accounts as they approach retirement age. It also helps them build up their retirement savings and prepare for their golden years.

Refer to the infographic below for the increase in contribution for both employees and employers.

What Does This Mean for Employers?

The CPF contribution increase for both employees aged 55 and below as well as senior employees aged above 55 to 70 will result in higher business costs for employers.

However, companies can manage the increase by adopting effective strategies such as increasing productivity, optimising employee performance, and leveraging technology in their operations.

Employers will also need to comply with the updated CPF contribution rates and communicate the changes to their employees.