What is Outsourcing?

Outsourcing is a strategic business practice that involves delegating specific tasks, processes, or functions to external third-party service providers. This approach allows organisations to leverage the expertise and resources of specialised professionals or companies to streamline operations, reduce costs, and focus on core business activities. Outsourcing has become a global phenomenon, spanning industries ranging from customer support and information technology to manufacturing and finance, offering businesses the flexibility and competitive edge needed to thrive in today’s dynamic marketplaces.What are the Benefits of Outsourcing AFO Function?

1. Cost Savings

One of the primary advantages is cost reduction. Outsourcing allows companies to access skilled professionals and specialised technology without the overhead costs associated with hiring and training in-house staff. Furthermore, outsourced providers frequently operate in cost-effective regions, contributing to even greater expense reductions.2. Expertise

Outsourcing firms specialise in accounting and finance, offering deep expertise that leads to improved accuracy and compliance with financial regulations. Their specialised knowledge ensures businesses stay current with evolving financial standards, reducing the risk of penalties and legal complications. This expertise also results in more accurate and timely financial reporting, facilitating better decision-making and enhancing stakeholders’ understanding of the organisation’s financial health.3. Focus on Core Competencies

By outsourcing non-core functions, such as accounting and finance, organisations can redirect their resources and attention to their core business activities. This allows leadership and employees to focus on strategic tasks and growth-oriented initiatives, enhancing overall productivity and competitiveness.4. Scalability

Outsourcing offers flexibility, allowing companies to scale their accounting and finance services up or down as needed. This adaptability is particularly valuable during periods of growth, seasonal fluctuations, or economic uncertainty.5. Access to Technology

Outsourcing providers often have access to advanced accounting software and tools. This can result in more efficient and automated financial processes, reducing the risk of errors and improving decision-making through real-time financial data.6. Enhanced Security

Reputable outsourcing firms invest in robust security measures to protect sensitive financial data. This can be especially reassuring for companies concerned about data breaches and cyber threats.7. Global Reach

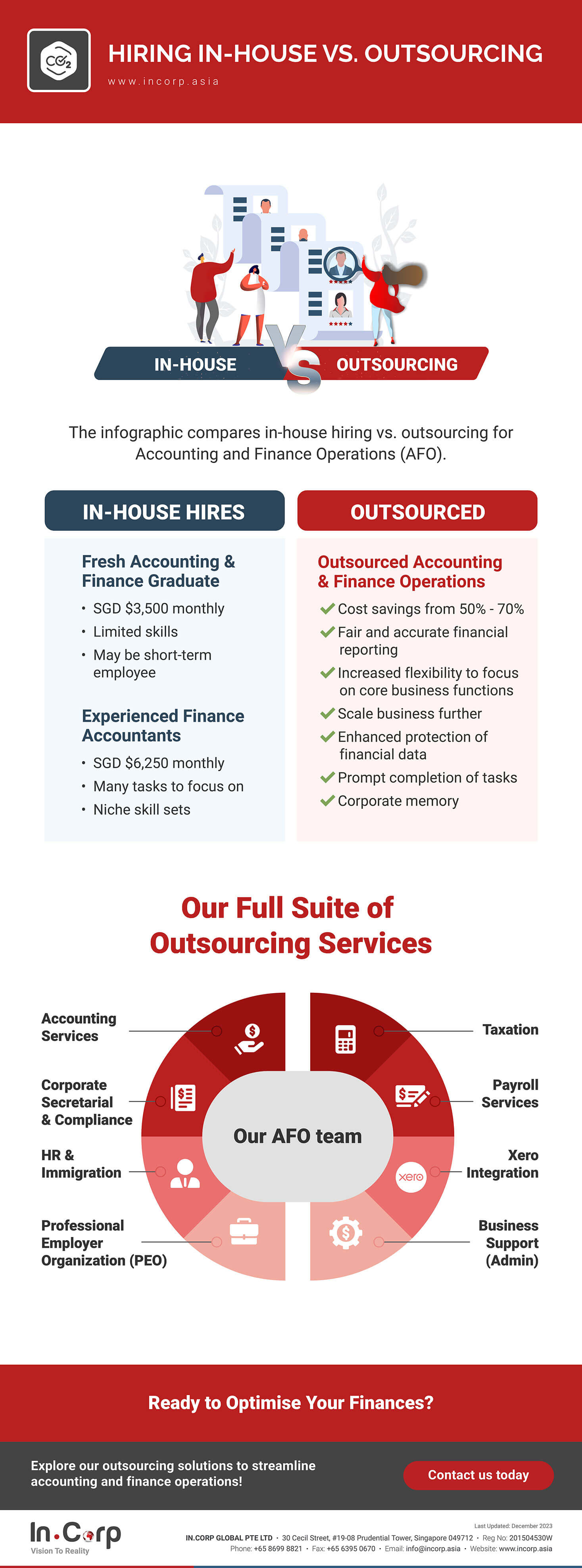

For businesses with international operations, outsourcing can provide access to global financial expertise and compliance knowledge, helping navigate complex international financial regulations. While outsourcing offers numerous benefits, it’s essential for organisations to carefully assess their needs, choose the right outsourcing partners, and establish clear communication and governance structures to maximise the advantages while managing potential risks effectively. For better understanding, view our infographic below on the differences between hiring in-house vs. outsourcing.