Leveraging Carbon Credits to Reduce Carbon Tax Liabilities

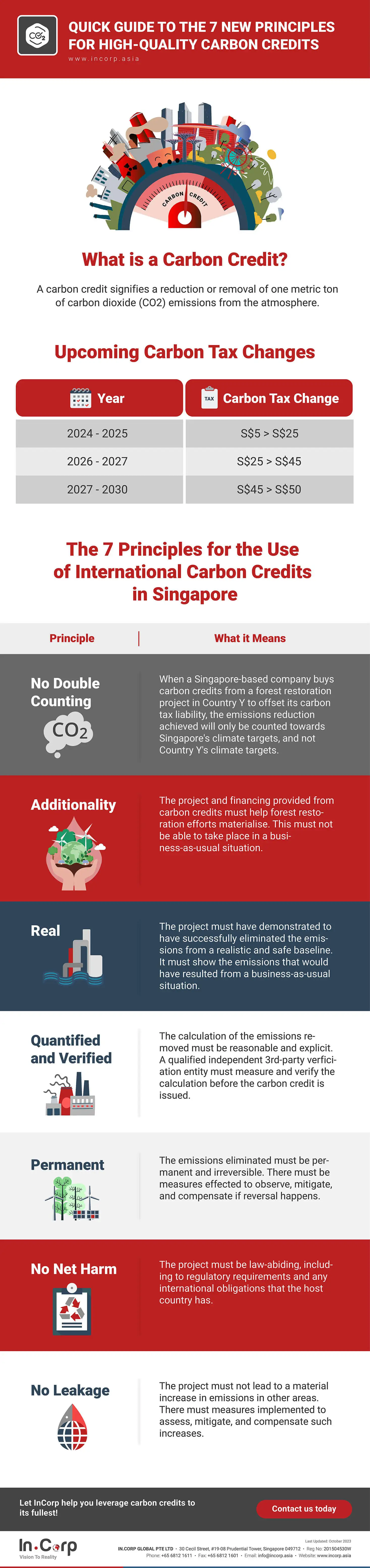

From 2024, companies in Singapore can use international carbon credits to offset up to 5% of their taxable emissions. Carbon credits are usually created via activities that endeavour to reduce, eliminate, or avoid carbon emissions. It is a type of certificate that signifies a reduction of one tonne of carbon dioxide emission.

In order to ensure that these carbon credits are of significant environmental quality, the government has produced 7 principles that every project must adhere to.

The new criteria allude to global standards, including that of one of the industry’s strictest standards, the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA).

In this infographic, we take a quick look at the new principles that your company should take note of.