Related Read: Company Registration in Singapore: Ultimate Guide for Foreigners

Why Should Companies Set Up Headquarters (HQ) in Singapore?

There are several reasons why companies should consider setting up their headquarters in Singapore, including:Strategic Location

Singapore is strategically located in the heart of Southeast Asia, with easy access to major markets in the wider Asia Pacific region, including China, India, and Japan. This makes it an ideal location for companies that want to expand their operations in Asia and take advantage of the region’s economic growth.Pro-business Environment

Singapore has a pro-business government that is committed to creating a conducive environment for business growth and innovation. The country has a stable political climate, an efficient regulatory system, and low corruption levels, which makes it an attractive destination for international businesses.Attractive Tax Regime

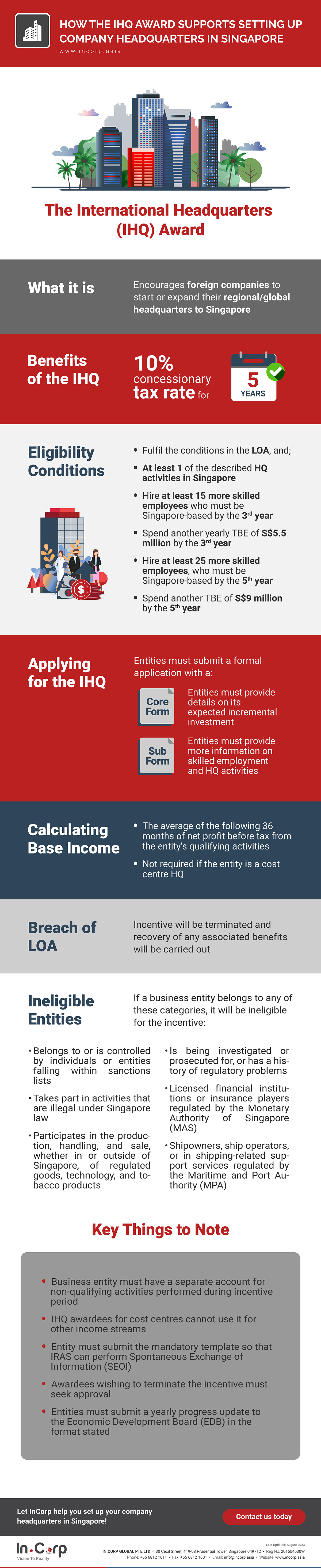

Singapore has a competitive tax regime, with low corporate tax rates and generous tax incentives for businesses. This makes it an attractive location for companies looking to expand their operations and reduce their tax burden. Related Read: Agility and Resilience: Singapore as a Regional Business HQ DestinationMotivating the Move to Singapore: The IHQ Award

The International Headquarters (IHQ) Award motivates foreign firms to start or expand their regional or global headquarters in these business activities for companies in Singapore:- Coordinating

- Managing

- Controlling