Overview of Singapore’s New Enterprise Innovation Scheme (“EIS”)

Singapore’s Budget 2023 signalled a shift in focus from giving away incentives to pursuing business growth and innovation. One of the government’s means of doing so is the newly announced Enterprise Innovation Scheme. This will further enhance productivity, innovation, and workforce quality for businesses to stay competitive in the new business environment.What is the Enterprise Innovation Scheme?

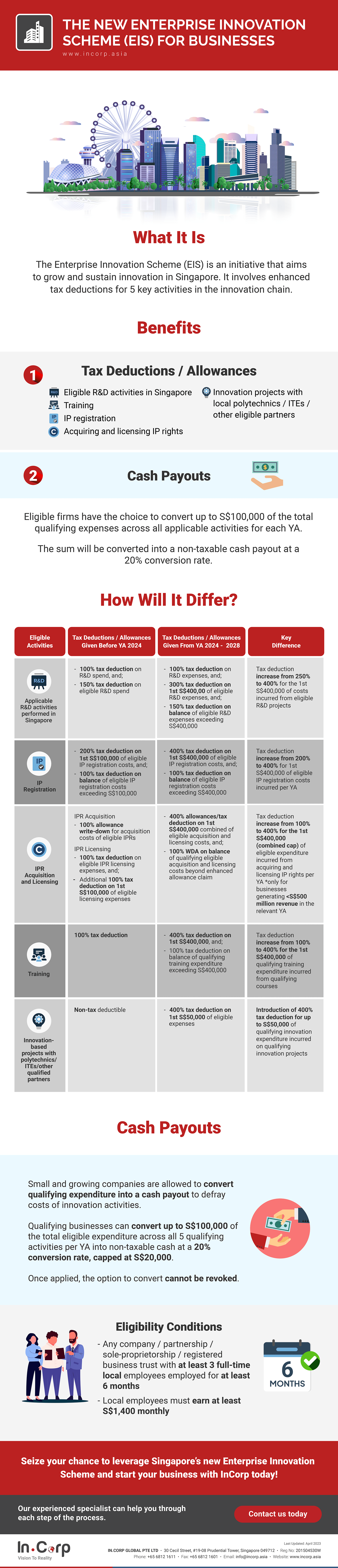

The EIS focuses on research and development (“R&D”), innovation, and capability development activities. The EIS will allow businesses that partake in research and development (R&D) activities to claim up to 400% in tax deductions. It will apply to 5 qualifying activities along the innovation chain:- Intellectual property (“IP”) registration

- Qualifying R&D activities performed in Singapore

- Training

- Innovation projects carried out with polytechnics and Institutes of Technical Education (“ITEs”) or other qualified partners

- The acquisition and licensing of IP rights

What Are the Benefits of the Enterprise Innovation Scheme?

Companies that undertake the qualifying activities can get enhanced deductions of up to 400% per dollar of their investment of qualifying expenditure (up to the applicable cap) for each qualifying activity. This therefore reduces the risks associated with R&D projects that usually deter fengagement. Ultimately, it will boost innovation in Singapore, build new capabilities and quality for businesses and workers, and protect its competitive position amidst the new global environment. Related Read: How Does the EIS Create Tax Savings From IP and R&D Costs?What is the Qualifying Period of the Enterprise Innovation Scheme?

The EIS will be available from Year of Assessment (“YA”) 2024 to 2028, a total of 4 years.